US Stock Exceptionalism Ending in 2025?

A Long-Term Perspective on US Stocks

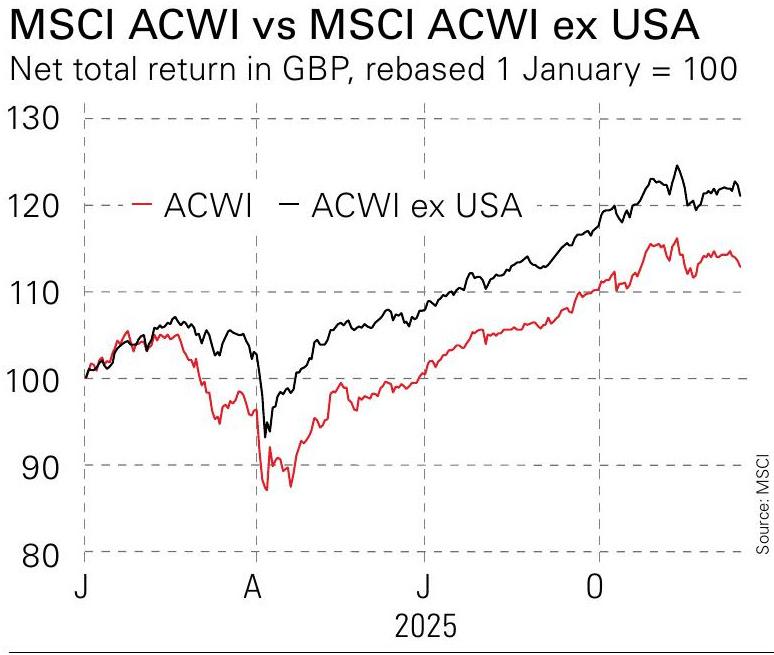

Assuming no major disruptions occur before the end of the year, 2025 is shaping up to be a far stronger year for global equities than anticipated just eight months earlier. The sharp sell-off triggered by US tariff announcements in early April proved intense initially, yet it reversed course more rapidly than forecasted, allowing markets to stage a robust recovery.

Despite all the rhetoric from Donald Trump, he substantially moderated the proposed tariff levels in practice. Numerous foreign governments negotiated agreements to appease him, featuring commitments on investment and trade that they are likely to sidestep fulfilling. Central banks started easing monetary policy more aggressively during this period. Consequently, stock markets surged: the MSCI ACWI index, encompassing both developed and emerging markets, has delivered an impressive 18% return in local currency terms, factoring in net dividends.

The complete repercussions of these tariffs may still be pending. It is entirely possible that the Trump administration will soon recognize that other nations have no real plans to direct hundreds of billions of additional dollars toward the US economy. They might also grow concerned over initial indicators of deceleration in economic sectors not propelled by AI-related expenditures. Should that happen, a renewed trade conflict with China and Europe could emerge. For the moment, however, conditions remain steady as they were.

A Long-Term View on US Stocks

Nevertheless, a notable shift has occurred. US equities have achieved approximately 16% returns in 2025, which qualifies as solid but above-average performance. This figure aligns closely with broader European results and lags behind numerous individual European nations, including the UK, as well as Japan and various emerging markets. Importantly, these are local-currency returns; accounting for the US dollar’s depreciation elevates performance in virtually every alternative market. Such results contradict the recent pattern of US dominance and defy the predictions from most market strategists at the outset of the year.

We cannot predict if this trend will persist into 2026. From a long-term standpoint, however, the MSCI USA index currently offers a forecast earnings yield – calculated as earnings divided by price – of about 4.5%. In comparison, the MSCI Europe index boasts over 6.5%, MSCI Japan hovers around 6%, and MSCI Emerging Markets approaches 7.5%.

Theoretically, earnings yield serves as a reliable indicator of anticipated long-term real returns. These earnings either return to investors as dividends or get plowed back into the business for expansion – in either scenario, a superior yield points to enhanced prospective returns. While markets rarely adhere strictly to theory, it remains evident that the US must sustain substantially superior earnings growth relative to global peers to counteract its lower starting yield.

Therefore, over an extended horizon, the probabilities favor a prolonged period where international markets surpass US performance. This rationale underpins our asset allocation portfolio – which I plan to update soon – maintaining a deliberate underweight position in the US, notwithstanding its impressive historical track record. This positioning appears poised to yield positive results at last.